e-invoicing

What is an e-invoicing?

The e-invoicing system is a procedure that aims to transform the process of issuing paper invoices and notices into an electronic process that allows the exchange of invoices and debit and credit notices and their processing in an organized electronic form between the seller and the buyer in an integrated electronic format.

Learn about e-invoicings

e-Invoicing

e-Invoicing

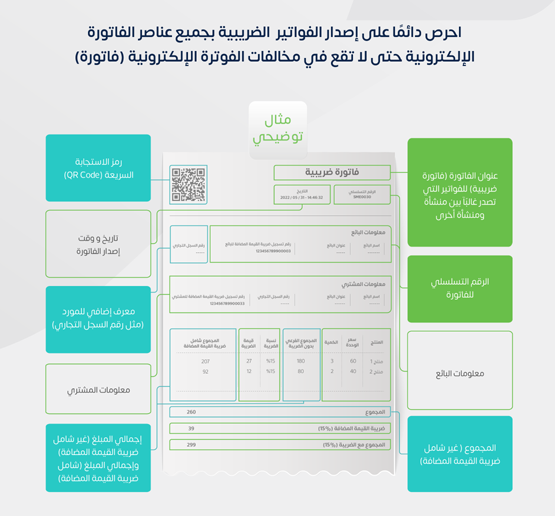

It is an invoice that is issued and saved in an organized electronic format through an electronic system and contains the requirements of the tax invoice. A handwritten or scanned invoice is not considered an e-Invoicing. There are two types of tax invoices (tax invoice and simplified tax invoice).

01Tax invoice

Tax invoice

It is the invoice that is often issued from one facility to another, containing all the elements of the tax invoice.

02Simplified tax invoice

Simplified tax invoice

It is the invoice that is often issued from an entity to an individual, containing the main elements of the simplified tax invoice.

03FEATURES OF E INVOICING

Streamlined Processes

E-invoicing facilitates seamless and automated invoice creation, delivery, and processing, reducing manual errors and streamlining financial workflows.

Cost Efficiency

By eliminating paper-based processes and manual data entry, e-invoicing significantly reduces costs associated with printing, postage, and manual labor.

Faster Payments

The speed of e-invoicing accelerates payment cycles, enabling businesses to receive payments faster and improve overall cash flow.

Enhanced Accuracy

Automated data capture and validation reduce the risk of errors, ensuring that invoiced information is accurate and compliant with regulatory requirements.

Improved Compliance

E-invoicing systems often come equipped with features to ensure adherence to tax regulations and other compliance standards, minimizing the risk of penalties.

Efficient Tracking and Reporting

Real-time tracking of invoices and robust reporting features provide businesses with valuable insights into their financial transactions, aiding in better decision-making.

Global Accessibility

E-invoicing enables businesses to send and receive invoices globally, breaking down geographical barriers and fostering international trade.

Secure Transactions

Advanced encryption and security protocols ensure the confidentiality and integrity of invoicing data, protecting businesses from potential fraud or data breaches.

Environmentally Friendly

Going paperless with e-invoicing contributes to environmental sustainability by reducing the need for paper and cutting down on carbon emissions associated with traditional mailing processes.

Integration Capabilities

E-invoicing systems can seamlessly integrate with other business software, such as accounting and Enterprise Resource Planning (ERP) systems, creating a cohesive and interconnected business ecosystem.

Customer Satisfaction

Faster, more accurate invoicing processes contribute to improved customer satisfaction, as clients benefit from timely and error-free transactions.

Scalability

E-invoicing solutions can scale with the growth of a business, accommodating increased transaction volumes without a proportional rise in administrative workload.

Mobile Accessibility

Many e-invoicing platforms offer mobile apps, providing users with the flexibility to manage invoicing processes on the go.

Finally

By incorporating these features into your website content, you can effectively communicate the advantages of adopting e-invoicing for businesses.